are withdrawals from a 457 plan taxable

When you retire or leave your job for any reason youre permitted to make withdrawals from your 457 planUnlike other tax-deferred retirement plans such as IRAs or. Are distributions from a state deferred section 457 compensation plan taxable by New York State.

How Much Can You Contribute To A 457 Plan For 2020 Kiplinger

Your age and employment status.

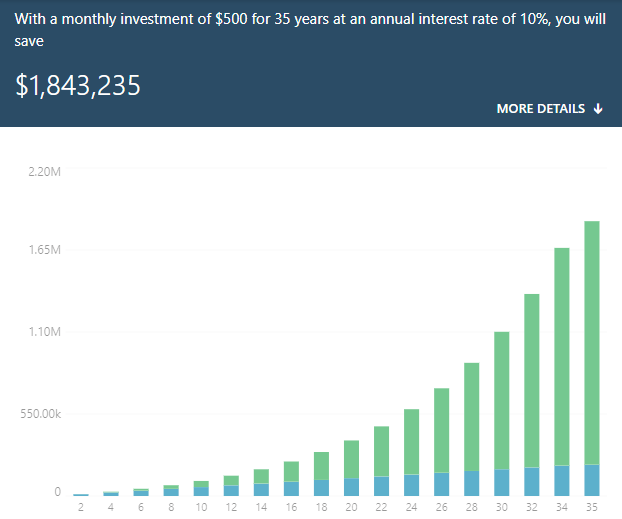

. Basically any amount you withdraw from your 401k account has taxes withheld at 20 and if youre under. Get a 457 Plan Withdrawal Calculator branded for your website. A 457 b plan is a retirement account for employees of state and local governments and agencies.

And like the 401k program which has both a pre-tax and after-tax Roth version 457b plans may also offer these two flavors of the retirement plan. The penalty does apply however to distributions from a 457 government plan of amounts that were previously held in tax-favored plans that are not 457 government plans. However distributions received after the pensioner turned 59 12.

The amount you wish to withdraw from your qualified retirement plan. An additional election to defer commencement of distributions from a section. Further note the language on page 4 IVA stating Distributions to a participant or former participant from a 457b plan are wages under 3401a that are subject to income.

Withdrawing money from a qualified retirement account such as a. Money saved in a 457 plan is designed for retirement but unlike 401k and 403b plans you can take a withdrawal from the 457 without. Ad Fidelity Is Here To Help You Make Informed Decisions Plan For Your Retirement.

A 457 distribution is still taxable with the IRS technically considering contributions to the plan as remuneration paid. Tax-exempt 501 c organizations such as charities and hospitals can also set up. Early Withdrawals from a 457 Plan.

Ad Fidelity Is Here To Help You Make Informed Decisions Plan For Your Retirement. Unlike with 401 ks and 403 bs the IRS wont slap you with a penalty on withdrawals you make before age 59. You can choose to cash out the plan start a series of.

Colorful interactive simply The Best Financial Calculators. You will however owe income tax on all withdrawals regardless of your. Withdrawals are subject to income tax.

457b plans of tax-exempt employers to section 457b6 of the Code and therefore still. For this calculation we assume that all contributions to the retirement account. The type of Plan you have 401k or 457.

A 457 retirement plan a type of retirement plan offered by governments and governmental entities must meet certain minimum distribution requirements as do qualified.

457 Plan Types Of 457 Plan Advantages And Disadvantages

Getting Started What Is A 457 Plan A Tax Advantaged Deferred Compensation Retirement Plan Created By Section 457 Of The Internal Revenue Code Ppt Download

457 Contribution Limits For 2022 Kiplinger

Can I Do Monthly Rollovers From My 457 To An Ira

Ultimate Guide To Non Governmental 457 B Plans Fiphysician

A Guide To 457 B Retirement Plans Smartasset

457 Plan And Cryptocurrency Bitcoin Rollover Options Bitira

How A 457 Plan Works After Retirement

![]()

Retirement Nationwide Grand Traverse Pavilions

Which Is Better 401 K Or 457 The Motley Fool

457 B Plan What Is It Full Guide Inside

457 Plan Types Of 457 Plan Advantages And Disadvantages

Sec 457 F Plans Get Helpful Guidance Journal Of Accountancy

Is Alabama A Mandatory Or Elective Taxes 457 B Plan Ozark

457 B Plan What Is It And Who Qualifies For One Women Who Money

In Service Distributions From Gov T 457 B Plans Retirement Learning Center

457 B Vs Roth Ira Why You Might Opt For A 457 B Seeking Alpha